Peshwar High Court Ruling: Section 7E (Property tax) of Income Tax Ordinance Declared Invalid in KPK

In a recent development, the Peshawar High Court (PHC) has made a significant decision regarding Section 7E of the Income Tax Ordinance, 2001, concerning taxes on immovable property. The court has ruled that this section, which imposes taxes through a deeming clause, does not meet the criteria of Capital Value of Assets and exceeds the legislative competence of Parliament. Consequently, it has been struck down by the court.

The decision came about following petitions filed by Latif Hakeem and others, challenging the legislation on three main grounds: parliamentary incompetence, discrimination, and being confiscatory in nature.

In the judgment authored by Justice Syed Arshad Ali, it was stated that according to Entry No 50 of the Fourth Schedule to the Constitution, Parliament lacks the authority to impose income tax on immovable property. The court disagreed with the reasoning upheld by the Sindh High Court, which had supported the legislation based on the law established in the Elahi Cotton Mills case and Entry No 47.

Furthermore, the Lahore High Court’s ruling, which acknowledged that unrealized income from immovable property cannot be taxed under the impugned legislation, was also considered. However, the PHC declined to interpret the legislation in a manner proposed by the LHC, asserting that it is the prerogative of Parliament to amend the law accordingly.

The petitioners, including Latif Hakeem, challenged the insertion of Section 7E through the Finance Act, 2022, in the Income Tax Ordinance, 2001. This section mandates that, from the tax year 2022 onwards, residents are deemed to have derived taxable income equal to five percent of the fair market value of their capital assets in Pakistan, taxable at a rate of 20 percent.

This ruling by the PHC marks a significant development in the legal landscape concerning taxation on immovable property, emphasizing the importance of legislative competence and adherence to constitutional provisions.

FBR to Raise Property Rates Aiming High...

FBR to Raise Property Rates Aiming High... US Dollar VS Pakistan’s Real Esta...

US Dollar VS Pakistan’s Real Esta... Key Real Estate Amendments in Finance A...

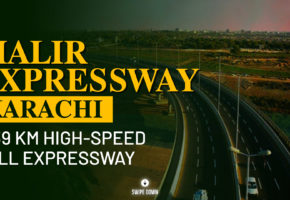

Key Real Estate Amendments in Finance A... Malir Expressway Karachi: A 39 km High-...

Malir Expressway Karachi: A 39 km High-...

There are no comments yet, add one below.