August 12, 2015

Pakistan’s Real Estate Sector in 2015

We are sight months into 2015, and as indicated by the specialists, the year has been a promising one for Pakistan’s land segment subsequent to the quantity of property exchanges that have occurred so far has expanded by 10 to 15% when contrasted with the earlier year.

Here are a percentage of the patterns that the real estate sector has seen in this way:

Residential Property.

- Demand for residential property (including apartments, houses and town houses) increased by five to 20%.

- Demand for vacant plots increased by 10 to 30%.

- Demand for rental property increased by nearly 40%.

- Property prices increased by five to 10% in Islamabad; 15 to 20 % in Karachi; and 5 to 15% in Lahore.

- Rental prices increased by 15 to 20% in Islamabad; 15 to 30% in Karachi; and 10 to 15% in Lahore.

Commercial Property.

- Demand for commercial property (including office space and retail space in commercial buildings, as well as standalone shops) increased by 10 to 25%.

- Demand for vacant plots increased by 10 to 15%.

- Demand for rental property increased by nearly 30%.

- Property prices increased by 20 to 30% in Islamabad; 15 to 35%in Karachi; and 12 to 20% in Lahore.

- Rental rates increased by 12 to 15% in Islamabad and Lahore, and 10 to 15% in Karachi.

General.

- Construction expenses expanded by almost eight percent.

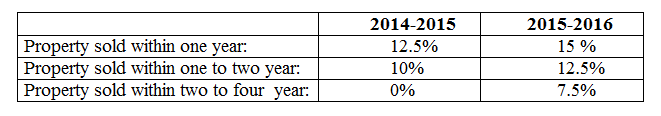

- The path in which Capital Gain Tax (CGT) (a rate of the increment in the estimation of the property in a given period) is resolved was amended in the 2015-2016 Federal Budget in the accompanying was:

(CGT is forced on private and business property proprietors who are exchanging property and is payable at the season of offering a property.)

Peshwar High Court Ruling: Section 7E (...

Peshwar High Court Ruling: Section 7E (... FBR to Raise Property Rates Aiming High...

FBR to Raise Property Rates Aiming High... US Dollar VS Pakistan’s Real Esta...

US Dollar VS Pakistan’s Real Esta... Key Real Estate Amendments in Finance A...

Key Real Estate Amendments in Finance A...

what is the amount of property of Pakistan in 20012 to 2016?